Decide

Automate with purpose

Automated decisioning for experience-driven customer journeys. Progress customer applications faster with enriched and contextual insights, and exception-based underwriting.

Outcomes

Our products give you the comfort of being supported by data-driven actionable insights.

Put the power back into your customers hands with calculator APIs configured to your product and policy requirements

Understand a customer’s financial position and application readiness through consent-driven journeys and unlock business improvements and optimisation opportunities

Help customers gain confidence and acquire knowledge to embark on their purchase journey

Understand application readiness, then manage your customers through to repurchase and refinance

Core capabilities

Programmable risk appetite

Configure auditable outcomes based on your risk appetite

Automation-first

50+ scaled and proven automation models for enrichment and decisioning

Data interoperability

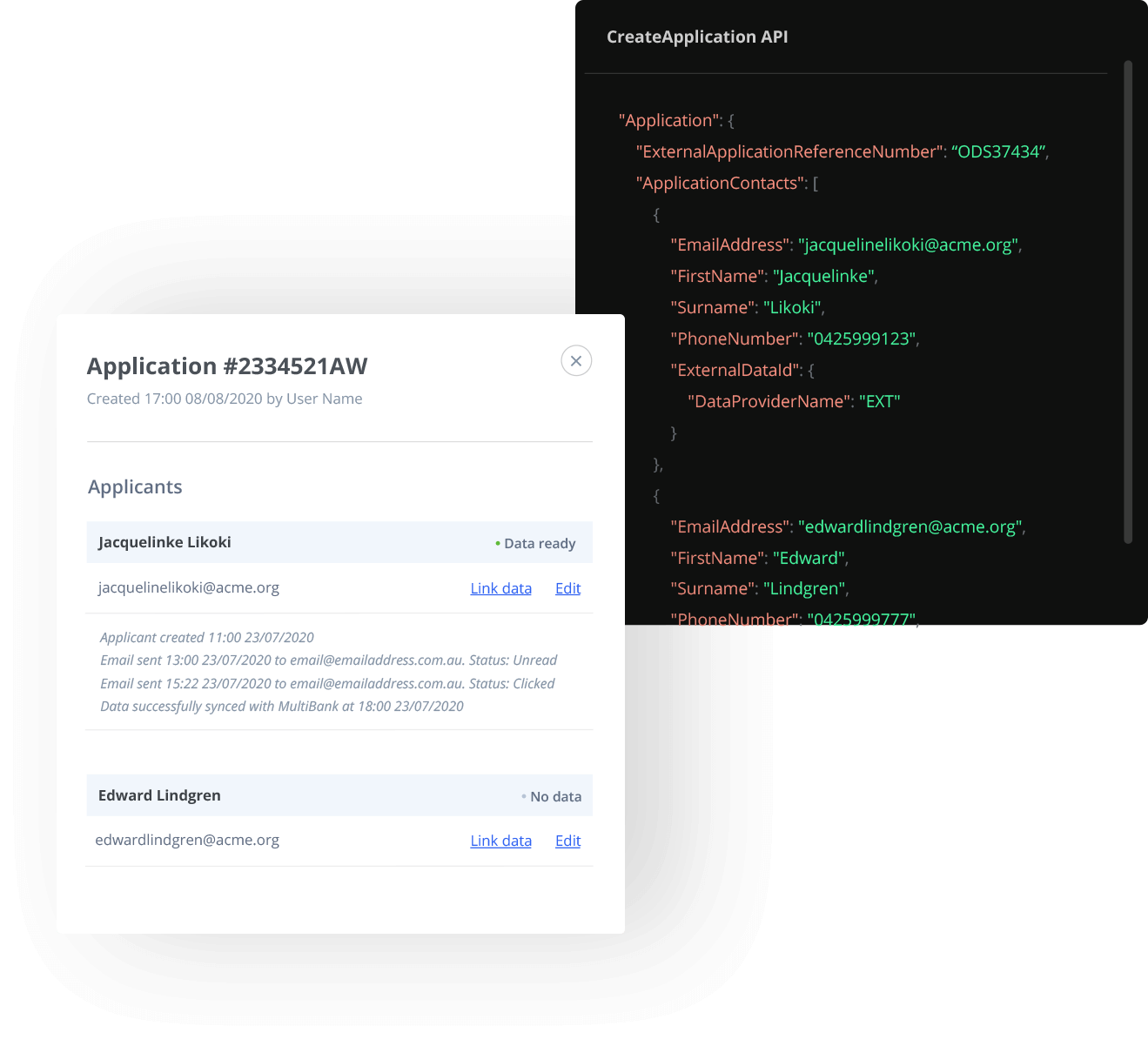

Seamless and streamlined interoperability: where data, APIs and UX come together to deliver actionable and contextual outcomes

Feature

Calculator APIs and pre-application tools configured to your policy so your customer can get an accurate understanding of their borrowing capacity, repayment obligations and upfront costs before starting their application journey.

Xapii Platform

Tiimely’s platform product componentisation allows you to quickly integrate and augment, without lengthy digital transformation projects or having to start from scratch.

Automate with purpose

Automated decisioning for experience-driven customer journeys. Progress customer applications faster with enriched and contextual insights, and exception-based underwriting.

A faster path to funding

Transform your loan origination journey, and increase efficiency with a seamless onboarding experience

Analyse, mitigate and grow

Manage your risk and compliance requirements whilst optimising your business for growth with Tiimely insights